When Does Etsy Send 1099

Diogenes On Twitter 3 A Driver Could Drive Part Time For Both Lyft And Uber And Be Paid Up To 40 000 Annually With No Reporting To The Tax Authorities At All And That S When Does Etsy Send 1099

twitter.com

If you processed 20000 usd and 200 transactions through etsy payments in a given year you should receive a 1099 k from etsy for each shop by mid february.

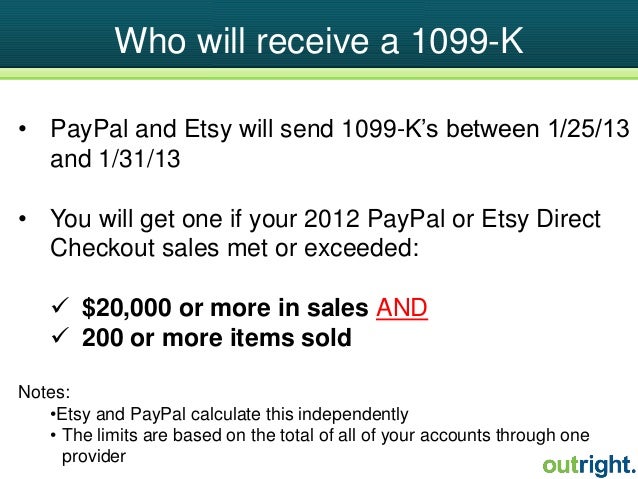

When does etsy send 1099. Its reported on 1099 misc box 7 1099 k box 1a or as cash check or credit. Etsy is required to issue a 1099 k form to you and the irs if you meet both of these requirements. You will still only receive one 1099 k form per shop from etsy if you qualify based on state and irs requirements.

Money you earn as a contractor consultant freelancer or other independent worker. As a payment processor paypal is also required to send out 1099 k forms to etsy sellers who meet the required thresholds. Etsy sends a third party network transaction payment card and 1099 k form to the seller and the irs.

The irs considers you self employed and have your own business for tax purposes if. Etsy please provide meus a status on when i will receive my 1099. The irs does not require you to report income reported on a 1099 k separately but you can use the information on the form to report gross sales or receipts when you file your taxes.

The 1099 k form reports all the sales that have been made using etsy payments. No you dont file a 1099 misc form you file a schedule c profit or loss from business to claim the income and expenses you earned on etsy. Paypal or etsy will only be sending a 1099 to people who bring in at least 20000 and have 200 or more transactions through pp or etsys direct checkout credit card processing service.

1099 k paypal sales from your own paypal account. Any business expenses related to your etsy shop can be itemized on your schedule c form which is discussed below. If youre in massachusetts youll receive a 1099 k form if you processed more than 600 in sales though etsy payments.

It has been 25 days since a replacement was promised. Etsy like other marketplaces is required by us law to send out a 1099 k tax form. Etsy issues a 1099 k form if you have received 200 payments in a year through etsy payments.

You had 20000 usd in sales through etsy payments during the calendar year. The 1099 paypal or etsy is sending out is only fulfilling their obligation under a new law it has nothing to do with whether or not you are required to file income taxes. A 1099 k form from etsy reports the total gross sales income you received through etsy payments during the last calendar year.

If you use your own paypal account to accept payments for etsy orders you may receive a separate 1099 k from paypal. I have spoken on the phone to someone two times and have had several email exchanges back and forth all have promised to send one and yet i still dont have my 1099. What to do if you receive a 1099 k from etsy.

You received 200 or more payments through etsy payments over that period.

How To Report Income To The Irs As An Etsy Seller Taxact Blog When Does Etsy Send 1099

blog.taxact.com

More from When Does Etsy Send 1099

- Does Walmart Dropship

- How Much Money Do We Get From Youtube Channel

- How To Sell Used Clothes Online Canada

- Etsy Forums Shipping

- Motivation Make Money Not Friends Quotes

- Mobile Aliexpress Online Shopping

- How Much You Can Earn From Youtube Ads

- How Much Money From Youtube For 1 Million Views

- Alibaba Owner Net Worth 2020

- How To Find Best Selling Items On Ebay Uk

- How To Earn Money Faster

- Monetizing Youtube Views

- What Does Etsy Mean By Favorite Materials

- Etsy Cost To Sell Calculator

- How Do You Monetize Videos