Should I Charge Sales Tax On Etsy

As a uk etsy seller you should make sure you understand the following taxes and pay them if necessary.

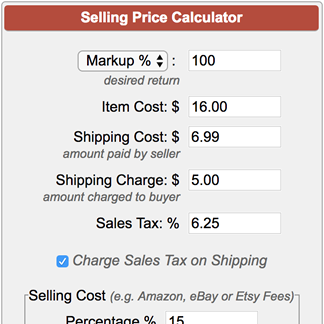

Should i charge sales tax on etsy. Just go to sales tax under your etsy and enter the rates for each us. Ultimately its up to you to determine whether you actually charge sales tax on etsy. Require sellers to charge sales tax to customers.

The result is that etsy now need to charge vat on all charges and listing fees. Heres the short answer. Find step by step instructions on how to collect sales tax for your etsy shop in etsys help center.

Everyone can earn up to 1000 without needing to register with hmrc or pay any tax. State where your business maintains a physical presence such as a store office or employee. Determine where you have nexus.

So if you have any us customers complain thinking that buying from canada is a way to avoid that obligation it doesnt. Nearly all of the states in the us. In some cases etsy collects and remits this tax on your behalf.

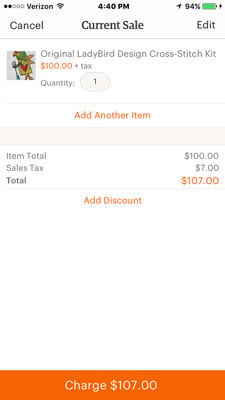

Find step by step instructions on setting up your etsy sales tax collection in the help section. Taxjar is here to give you a hand with all that. State sales tax is included in the total amount transferred to your payment account.

If youre in one of these states you may be charged sales tax on your etsy orderwe are required by your states laws to charge this tax. Many us states recently started collecting sales tax on online purchases. Im unfamiliar with any taxes a canadian seller might be obligated to charge but if you ship to any of the us states that now require sales tax its automatically calculated collected and remitted by etsy.

Here is our handy guide to sales tax for etsy sellers. The data you download will include sales taxes charged and thats about where etsy sales tax reporting support ends. Aside from sales in states where etsy automatically collects and remits tax you have a choice as to whether or not to charge it.

If you are selling items most likely you will have to deal with sales tax. You must collect sales tax sometimes called a franchise tax a transaction privilege tax or a use tax among other aliases on most goods and some services delivered to a customer who lives in a us. You may also need to collect and remit state sales tax.

State or zip code canadian province or country where you would like to charge sales tax. Once youve set up your sales tax rates shoppers will be charged state sales tax on orders shipped to those destinations. When a shopper from that area buys from you sales tax will automatically be charged.

Read what etsy sellers need to know about collecting state sales tax for more details. If you have a tax exempt status but are still charged sales tax click i still need help and we can assist. Pay your state sales tax.

When you do your quarterly sales tax you will be asked to break it all down so keep good records. So if your store has sales.

What Are The Fees And Taxes For Selling On Etsy Etsy Help Should I Charge Sales Tax On Etsy

help.etsy.com

More from Should I Charge Sales Tax On Etsy

- Single Mom Needs Money Fast

- How To Make Money From Home As A Teenager Online

- Do You Have To Pay Taxes On Etsy Sales

- Aliexpress Clothes For Women

- How Much Does Adsense Pay Per 1000 Views In Pakistan

- Starting An Etsy Shop Taxes

- Legitimate Work From Home Jobs Hiring Now Part Time

- How To Get Products For Ecommerce Website

- What Should I Sell Online In Pakistan

- Funny Online Selling Memes

- How To Increase Cpm Youtube

- How Much Does Youtube Pay Per View 2018

- Smoky Adobo Buffalo Wild Wings Review

- Top 10 Cpm Ad Networks

- Is It Cheaper To Ship Through Etsy