Selling On Etsy Taxes

State sales tax is included in the total amount transferred to your payment account.

Selling on etsy taxes. Her total taxable income is 25000 and her income tax bill will be 2500 which is calculated as follows. How to view your fees and taxes. If youre a vat registered seller you may be required to charge vat on the items that you sell on etsy.

Selling your kids old bicycle is not likely to cause any tax consequences but when you sell crafts vintage or specialty items on websites like etsy you must report and pay taxes on your net income. Understanding your tax obligation is necessary to avoid hefty fines and penalties from the internal revenue service or your states department of revenue. She also has an etsy store and for the tax year 20192020 makes profits of 5000.

Susan will get credit for any tax paid in her job. If you sell goods on etsy and reside in the us or canada you have the option of either including applicable taxes in your listing prices or excluding applicable taxes from your listing prices and then using etsys sales tax tool to calculate the tax owed on each sale with the exception of quebec where etsy is responsible for collecting vat on digital goods in certain cases. Once youve set up your sales tax rates shoppers will be charged state sales tax on orders shipped to those destinations.

In some cases etsy collects and remits this tax on your behalf. So i am new to etsy and am in the process of setting up shop. You may also need to collect and remit state sales tax.

Whether selling on etsy is a hobby or a full time business the income is taxable if net earnings reach 400 or more for the year. Tax tips july 12 2019. You will also likely need to pay self employment tax on your profits and in some locations you may also be responsible for charging and collecting sales tax.

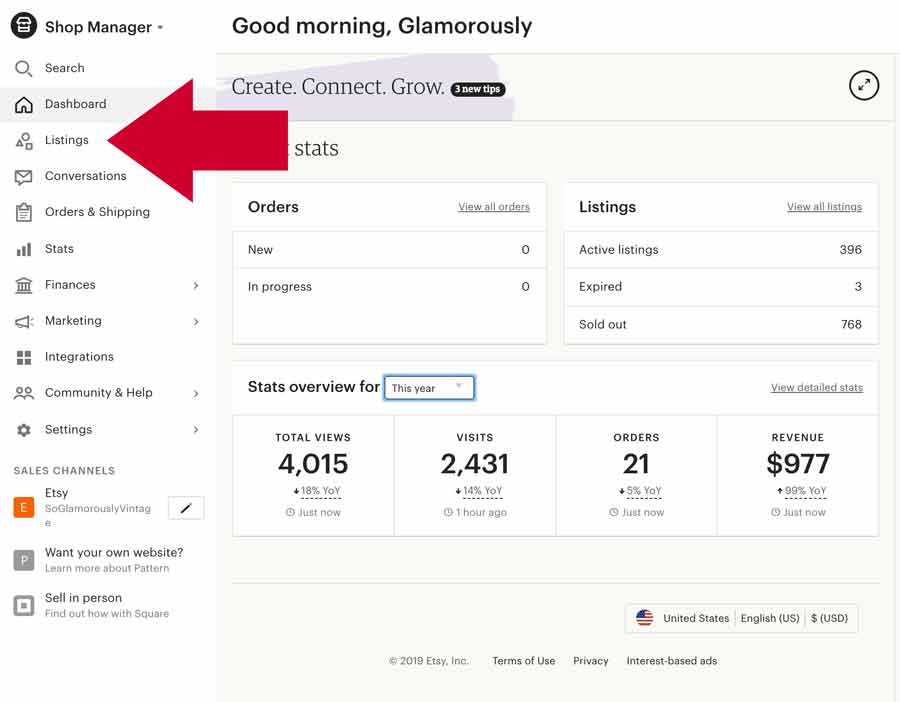

Read what etsy sellers need to know about collecting state sales tax for more details. Click the your account icon then click shop manager. 12500 x 0 0 12500 x 20 2500.

Pay your state sales tax. Susan has a part time job with a salary of 20000. Through some research i found that i need to apply for a sales tax permit since i will be selling infrom texas in order to collect and remit sales tax to the state when i sell to texas residents.

Taxes for etsy ebay letgo and more. To view your payment account which includes fees and taxes from selling on etsy. Find step by step instructions on how to collect sales tax for your etsy shop in etsys help center.

10 Sites Like Etsy To Sell Handmade Crafts And Grow Your Business Selling On Etsy Taxes

www.shoplo.com

More from Selling On Etsy Taxes

- Google Search Ads Logo Png

- About Etsy Ads

- What Is A Good Cpm For Youtube

- How Much Does Adsense Pay Per 1000 Views Youtube

- Top Cpm Countries Youtube

- Adwords Certification Exam

- I Want To Stay At Home

- Top Comedy Movies On Netflix Reddit

- Cpm Calculator Formula

- Ways To Make Money During Covid 19

- Etsy Help For Sellers

- How Much Does It Cost To Join It Works

- How Do I Start A Dropshipping Business In A Week

- How Much Should A First Time Home Buyer Put Down On A House

- Etsy Shop Icon