Etsy Tax Deductions

Three Accounting Tools That Are Perfect For Etsy Sellers Etsy Tax Deductions

www.smallbusinessbonfire.com

Here are 101 tax deductions to get you started.

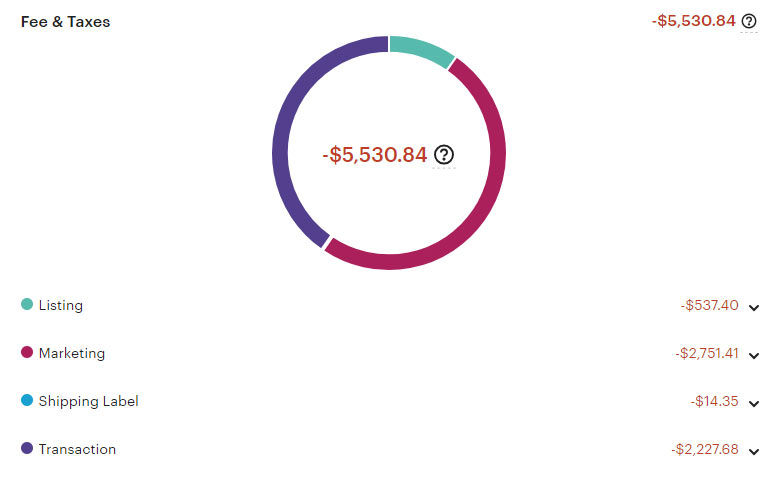

Etsy tax deductions. Dont miss out on a single tax deduction for your etsy shop business. Whether you sell handmade products craft supplies or vintage lovelies we have got you covered. Then etsy will add a fee for the sales tax to your etsy bill so that we can remit the tax to the state of washington or pennsylvania.

4 commonly missed tax deductions for etsy shop owners. Finding legitimate tax deductions related to your etsy business by kate gatski kate shoup if your etsy shop is a proper business rather than a hobby and its set up as a sole proprietorship youre free to deduct shop related expenses from your taxable income. Any amount you spend on materials you purchase as an etsy shop owner for your business.

1 supplies and subscriptions. The most popular color. Thats because every time you write off an expense you lower your taxable income putting the money you spend on your business back in your pocket.

Well youre in luck because here they come. 15 top tax deductions for etsy sellers as an etsy seller you can save hundreds even thousands of dollars at tax time by deducting business expenses. There are 222 tax deduction for sale on etsy and they cost 1190 on average.

Here are 10 deductions common for etsy sellers to include. Lets go through some deductions that you may need to know about in order to maximize your tax savings. The estimated tax worksheet provided by the irs includes instructions for determining how your estimated deductions will impact your quarterly taxes.

There are at least 101 tax deductions for etsy sellers. You can factor in deductions with each quarterly tax payment and use what you paid last year as a guide. The sales tax will be included in the order information and the fee for the sales tax will be on your etsy itemized billincluding the relevant order number.

There are 294 tax deductions for sale on etsy and they cost 1306 on average. Did you scroll all this way to get facts about tax deductions. The most common tax deduction material is ceramic.

Payments processed through your own paypal. Dont worry though you only pay taxes on your profit gross sales minus expenses including etsy fees and deductions. Self employment tax is comprised of social security and medicare taxes the percentage that would normally be withheld from your paychecks as an employee plus the percentage your employer would have contributed.

This post contains affiliate links see my disclosure here. For more information on this check out this seller handbook post. If your total net income from etsy sales is 400 or more you must also pay self employment tax on the income.

The most common tax deductions material is ceramic.

More from Etsy Tax Deductions

- Selling Art On Etsy Uk

- Simple Ways To Earn Money For Students In India

- How Can I Earn Money At Home Quora

- Amazon Handmade Mexico Vender

- How To Earn Money Using Computer

- Ad For Football Programs Examples

- How To Earn Money From Home In Tamil Nadu

- Etsy Raising Prices

- How To Become Successful In Etsy

- Top 20 Richest Youtubers In The Philippines

- Tumblr Etsy Stickers

- Make Money From Home Online Data Entry Jobs

- How Much Does It Cost To Run A Shopify Store

- Can You Make Money On Printful

- How To Make Money Through Youtube Account