How Do You Budget Your Money The 50 20 30 Rule

50 30 20 Budgeting Rule Save Money Australian Lending Centre How Do You Budget Your Money The 50 20 30 Rule

www.australianlendingcentre.com.au

The 50 20 30 rule makes you look at your necessities such as housing and utilities and make them fit under that 50 percent umbrella omoth says.

How do you budget your money the 50 20 30 rule. Your essential needs savings and debts and wants. From here adjust your spending to ensure youre falling into the 50 20 30 parameters. If you start a budget with the 50 20 30 rule you can more easily tell you if youre spending more than you can really afford particularly on living expenses and necessities.

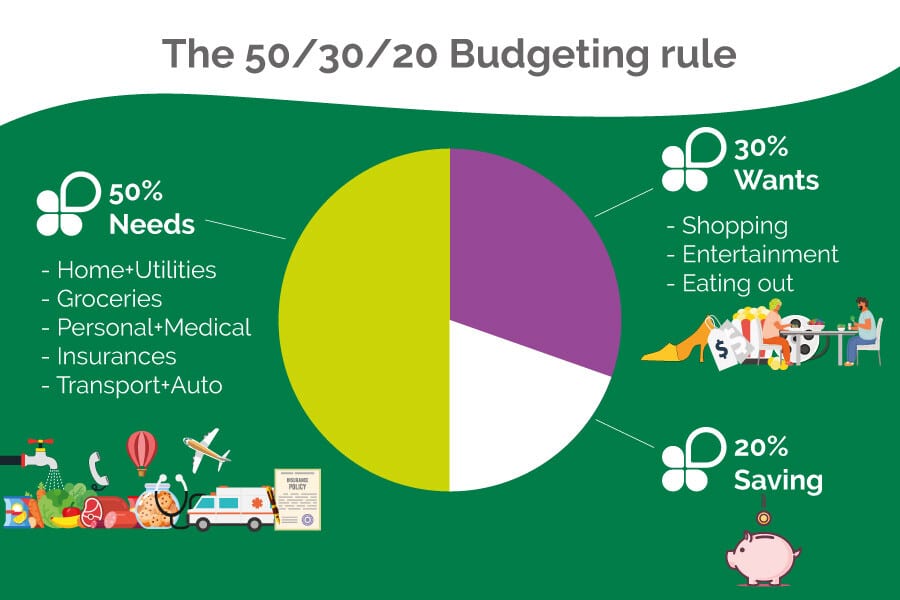

According to the 503020 rule you should divide your money into three categories upon receiving a paycheck. The 503020 rule budget only requires you to track and divide your expenses into three main categories. 50 percent of your paycheck should be set aside for the essentials the core things you need to live.

The 503020 rule budget can be a great tool for people who dont have the patience for tracking their spending in detailed categories. Using the 50 30 20 rule you can spend no more than 1750 on your needs per month. The rule states that you should spend up to 50 of your after tax income on needs.

If you are struggling to save money and pay off debt the 50 20 30 rule can help you budget in accordance with your financial goals according to rob berger founder of the dough rollerhe says. The 50 20 30 or 50 30 20 budget rule is an intuitive and simple plan to help people reach their financial goals. The premise is simple you allocate 50 of your budget for your essentials 30 for extras and 20 for debt and savings.

The learnvest smart budget will analyze your current spending to see how it stacks up against the 502030 rule. The 503020 rule is a budgeting framework that outlines what percentage of your income to allocate for the three of the most important parts of your budget. Needs wants and savings or debt.

A personal shift in. If youre overspending on stuff you want but dont need its time to cut back to save more.

How To Budget Using The 50 20 30 Rule How Do You Budget Your Money The 50 20 30 Rule

www.dumblittleman.com

More from How Do You Budget Your Money The 50 20 30 Rule

- Free Poshmark Sale Signs

- Cpm Ad Networks For Blogs

- How To Make Money From Cpm Tv

- Legit Cpm Sites

- How Can I Make Money Fast Online

- Average Cpm 2020

- Etsy Shop Owner Cannot Complete Transaction

- Youtube Monetization Problems

- Who Is The Richest Youtuber In Tamilnadu

- Selling Items On Etsy And Taxes

- Online Selling Memes

- Aliexpress Login Page

- Making Money On Youtube Forum

- How To Make A Youtube Channel Mobile 2020

- Youtube Monetization Requirements Reddit

/GettyImages-483822321-fdd7a727e3bd40a5bbed22d7b46179e7.jpg)

/the-50-30-20-rule-of-thumb-453922-final-5b61ec23c9e77c007be919e1-5ecfc51b09864e289b0ee3fa0d52422f.png)