Does Etsy Send You A 1099

If you receive a 1099 k form etsy is required to send a copy of the same form to the irs andor the tax authority of your state.

Does etsy send you a 1099. You may qualify to receive a 1099 k form if you meet certain profit and sales thresholds. Record mileage every time you make a trip for your business. Money you earn as a contractor consultant freelancer or other independent worker.

If you use your own paypal account to accept payments for etsy orders you may receive a separate 1099 k from paypal. Etsy please provide meus a status on when i will receive my 1099. The irs does not require you to report income reported on a 1099 k separately but you can use the information on the form to report gross sales or receipts when you file your taxes.

You must pay taxes if you own a shop on etsy and also treat it as a business. Etsy sellers dont have to worry about making any additional reports as etsy takes care of the 1099 k forms itself. We recommend that you contact paypal for more information.

It has been 25 days since a replacement was promised. Etsy is required to issue a 1099 k form to you and the irs if you meet both of these requirements. You had 20000 usd in sales through etsy payments during the calendar year.

Holy cow if youve hit the threshold for etsy to send you a 1099 k 20000 sales you definitely need to get your stuff together. This is absolutely a business. The irs considers you self employed and have your own business for tax purposes if.

I have spoken on the phone to someone two times and have had several email exchanges back and forth all have promised to send one and yet i still dont have my 1099. If youre in massachusetts youll receive a 1099 k form if you processed more than 600 in sales though etsy payments. As a payment processor paypal is also required to send out 1099 k forms to etsy sellers who meet the required thresholds.

You received 200 or more payments through etsy payments over that period. If you processed 20000 usd and 200 transactions through etsy payments in a given year you should receive a 1099 k from etsy for each shop by mid february. Etsy will report your sales to the irs through the 1099 k forms.

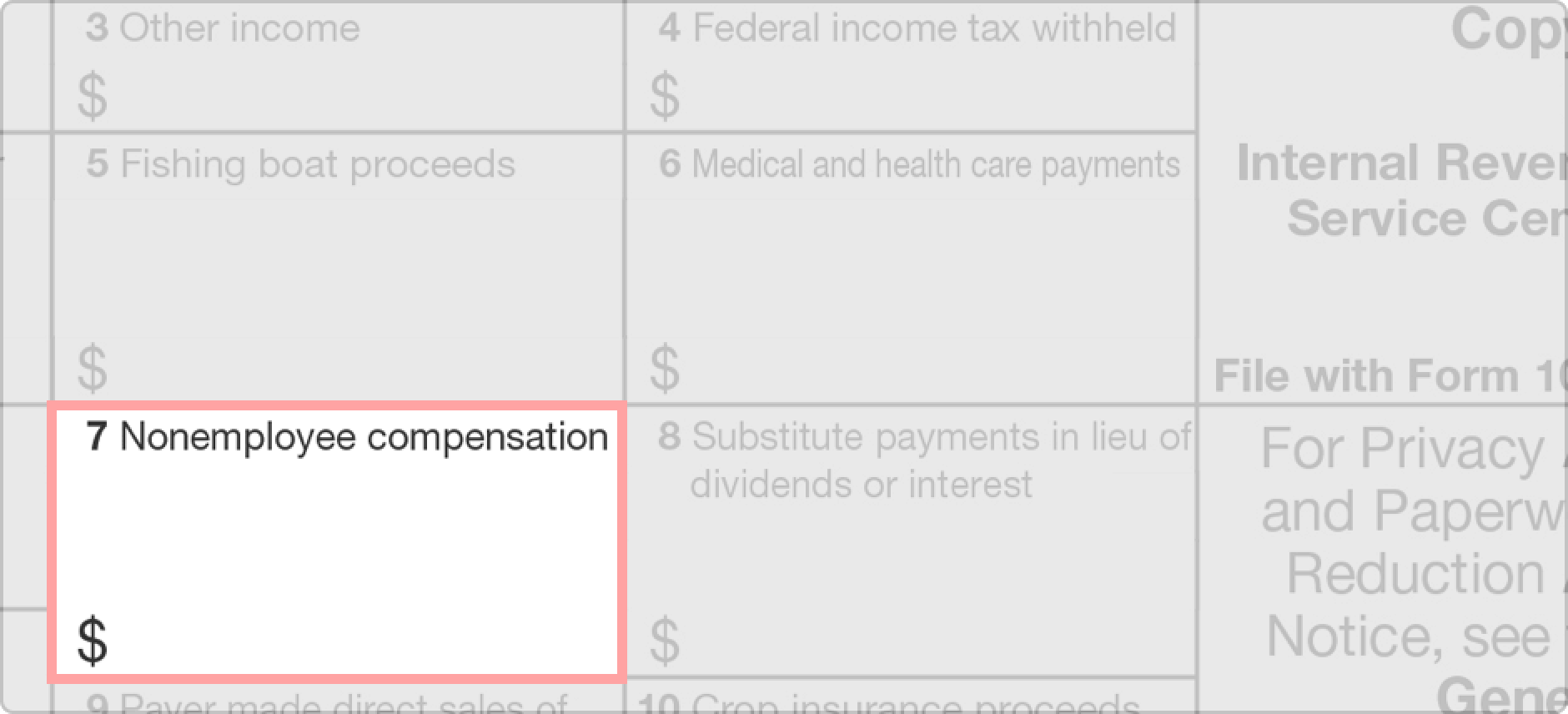

Its reported on 1099 misc box 7 1099 k box 1a or as cash check or credit. 1099 k paypal sales from your own paypal account. Any business expenses related to your etsy shop can be itemized on your schedule c form which is discussed below.

More from Does Etsy Send You A 1099

- How Many Views Do You Need To Get Paid From Tik Tok

- Google Adwords Logo Svg

- What Is Average Cpm

- How Can I Make Money From Home

- What Is Shopify And Oberlo

- Do I Need A Sellers Permit To Sell Online In Wisconsin

- How Can I Make Money Working With Dogs

- How To Earn Money From Home Without Investment

- Which Handmade Items Sell Best

- How To Earn Money Online At Home In Delhi Without Investment

- Aliexpress Official Xiaomi Store

- How Much Do You Get Paid For Youtube Videos In South Africa

- Support Online Seller Quotes

- Formula Del Cpm

- Birthday Candy Buffet Table Ideas