Do You Have To Pay Taxes On What You Sell On Etsy

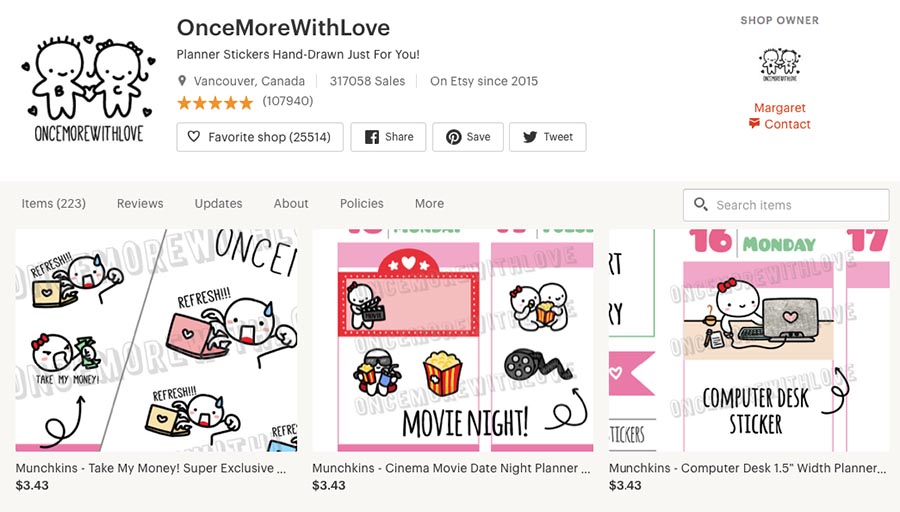

Shopify Vs Etsy Understanding The Differences Easyship Blog Do You Have To Pay Taxes On What You Sell On Etsy

www.easyship.com

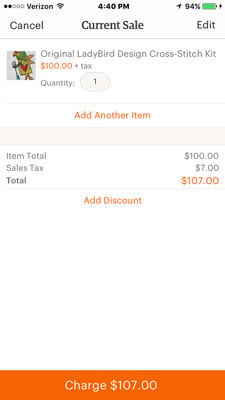

The Sell On Etsy Mobile App Dummies Do You Have To Pay Taxes On What You Sell On Etsy

www.dummies.com

Selling your kids old bicycle is not likely to cause any tax consequences but when you sell crafts vintage or specialty items on websites like etsy you must report and pay taxes on your net income.

Do you have to pay taxes on what you sell on etsy. There are entrepreneurs earning thousands on the platform unaware that they may have to pay tax as a sole trader. If youve got a job you still need to declare this additional income to hrmc unless its under 1000. You will also likely need to pay self employment tax on your profits and in some locations you may also be responsible for charging and collecting sales tax.

If you are required to file a sales tax return in these states you do not need to report sales tax on etsy sales. Etsy shops that meet the requirements for businesses are required to pay taxes on that income and may be subject some additional tax including the following. There are 2 types of taxes that might apply to your etsy shop.

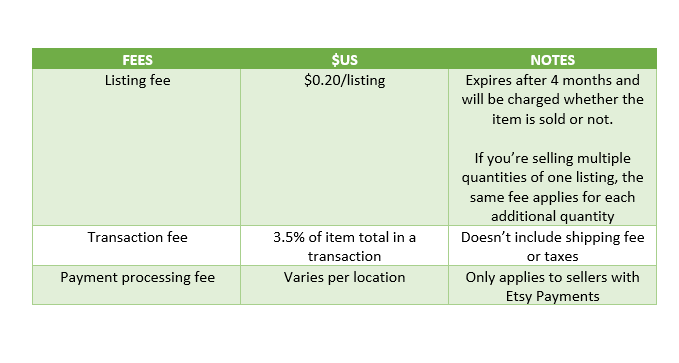

If you are really small or in the early stages of your etsy business it is unlikely that you have a vat registration number. If your current balance is negative at the end of the month youll have an amount due on the first on the next month. When your outstanding balance is due youll receive an email from etsy.

In this case etsy will be charging you vat of 20 on top of all the charges and listing prices you see. If you make taxable income regardless of your age the amount you make your occupation or whether youre a student you must report it to the cra. As long as you sell your items for less than they cost you you dont have to pay taxes on the money you make.

Profit or loss from business. Youll file a schedule c annually to report profits or losses regardless of whether you have registered your etsy shop as a business. If youve already got a day job and you sell on etsy as an extra your personal allowance will be taken into account by the company you work for when they tax your pay.

All you need to do is state that the sales were made through etsy. In the sell on etsy app you can pay your. When you start selling on etsy uk you are asked to enter a vat registration number.

If you sell goods on etsy and reside in the us or canada you have the option of either including applicable taxes in your listing prices or excluding applicable taxes from your listing prices and then using etsys sales tax tool to calculate the tax owed on each sale with the exception of quebec where etsy is responsible for collecting vat on digital goods in certain cases. Making back more than you paid once in a while lets say youre getting rid of a painting that cost you 30. If you have a physical presence in a state where etsy collects and remits state sales tax on your behalf you may still be required to file a state sales tax return to that state.

If you make any sales through etsy payments your fees will automatically be deducted.

A Jeweler S Guide To Online Marketplaces How To Sell Jewelry On Etsy Do You Have To Pay Taxes On What You Sell On Etsy

picupmedia.com

More from Do You Have To Pay Taxes On What You Sell On Etsy

- Which Products Are Most Sold Online In India

- Google Adsense Pin Envelope

- Top Ad Networks 2020

- Easy Ways To Make Money From Home Online

- How Can I Get Money Fast When Unemployed

- Cute Crafts To Sell On Etsy

- How Much Do Ebay Sellers Make A Year

- Learn How To Sell Online

- Adsense Revenue Calculator

- What To Sell Online Ideas

- Ways To Make Money Online In South Africa 2020

- How Much Money Do You Need To Start Dropshipping On Shopify

- Ebay Valet 2018

- Youtube Monetization Changes 2020

- What Digital Products Can I Sell Online