Do You Have To Collect Sales Tax On Etsy

Origin Based And Destination Based Sales Tax Collection 101 Do You Have To Collect Sales Tax On Etsy

blog.taxjar.com

A Comprehensive List Of E Commerce Sales Tax Laws By State Grow Wire Do You Have To Collect Sales Tax On Etsy

www.growwire.com

While etsy provides a means to apply taxes to your transactions we do not warrant that these tax amounts will fully satisfy your sales and use tax reporting obligations.

Do you have to collect sales tax on etsy. Find step by step instructions on how to collect sales tax for your etsy shop in etsys help center. Below are five things you should know about sales tax on etsy. So for example if you run your etsy shop from your fifth floor.

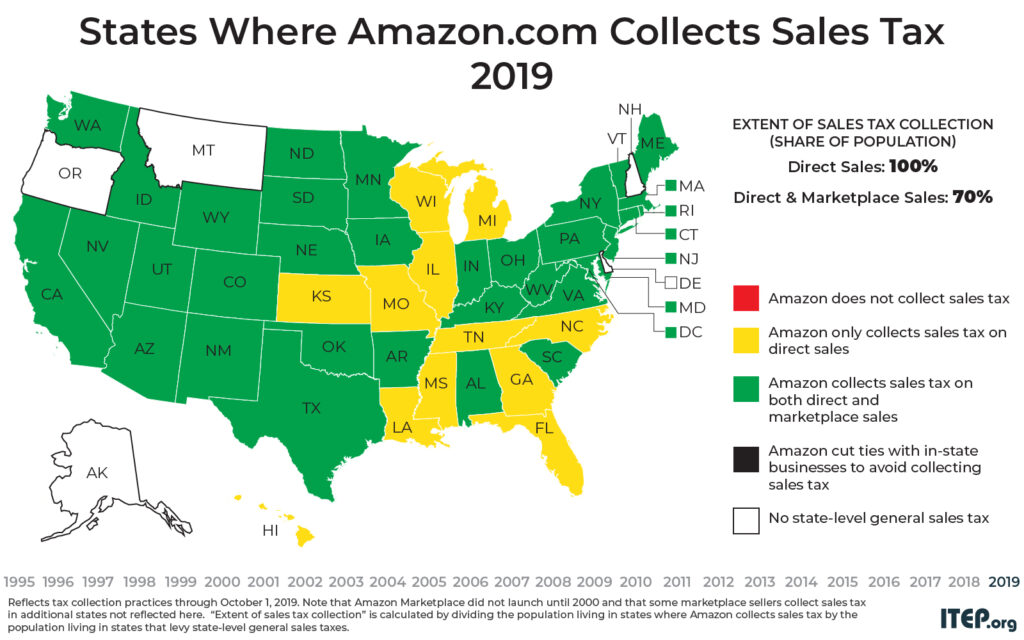

Pay your state sales tax. Of revenue they will send you all the discretionary sales tax rates. Etsy collects and remits sales tax for about 42 of the 50 us states as well as gst for australia and new zealand under new sales tax laws which make them the responsible party.

When you register with the fl dept. If you have a physical presence in a state where etsy collects and remits state sales tax on your behalf you may still be required to file a state sales tax return. You can set tax rates between 10000 and 250000.

Heres the short answer. You have to add them individually by zip code it took me all day to do this. State sales tax is included in the total amount transferred to your payment account.

Its on you to figure out if you have to charge sales tax in a particular state. If someone from fl purchases an item from you you add 6 sales tax and then add the surtax for the county they live in. Thats the sales your etsy shop makes before deducted any etsy.

These easy to follow 6 mini guides will have you on top of the tax side of. All you need to do is state that the sales were made through etsy. To find out whether the turnover of your etsy uk shop for vat you need to check your gross sales.

State where your business maintains a physical presence such as a store office or employee. You have no responsibility for these taxes so you do not need to know the details as they are part of etsys accounting not yours. If one lives on or near a state border and does business on a regular basis in two or more states they should have sales tax permits in each state.

If you sell goods on etsy and reside in the us or canada you have the option of either including applicable taxes in your listing prices or excluding applicable taxes from your listing prices and then using etsys sales tax tool to calculate the tax owed on each sale with the exception of quebec where etsy is responsible for collecting vat on digital goods in certain cases. Once youve set up your sales tax rates shoppers will be charged state sales tax on orders shipped to those destinations. For a final determination on these matters please seek assistance from your tax advisor.

If you sell outside of those states however collecting sales tax might be your responsibility whether youre doing big business on the site or just starting out. Businesses do not pay vat but it is their responsibility to collect vat on behalf of hmrc.

A Lump Of Coal For 12 States Not Collecting Marketplace Sales Taxes This Holiday Season Itep Do You Have To Collect Sales Tax On Etsy

itep.org

More from Do You Have To Collect Sales Tax On Etsy

- Printable Stay At Home Mom Daily Schedule Template

- Make Money Online Without Investment

- China Phone Aliexpress

- How Much Money Do Youtube Channels Make Per View

- How Do You Make A Youtube Video On Xbox

- How Do I Sell On Etsy Uk

- How To Make Money While Pregnant And Unemployed

- Gearbest Affiliate Program Review

- How Do I Get Started Selling Online

- Online Selling Websites In India

- Next Money Making Trend

- Where Can I Sell Besides Etsy

- Make Money With Youtube Pdf

- What Online Store Is Like Amazon

- What Is The Quickest Way To Make Money On Gta 5 Online